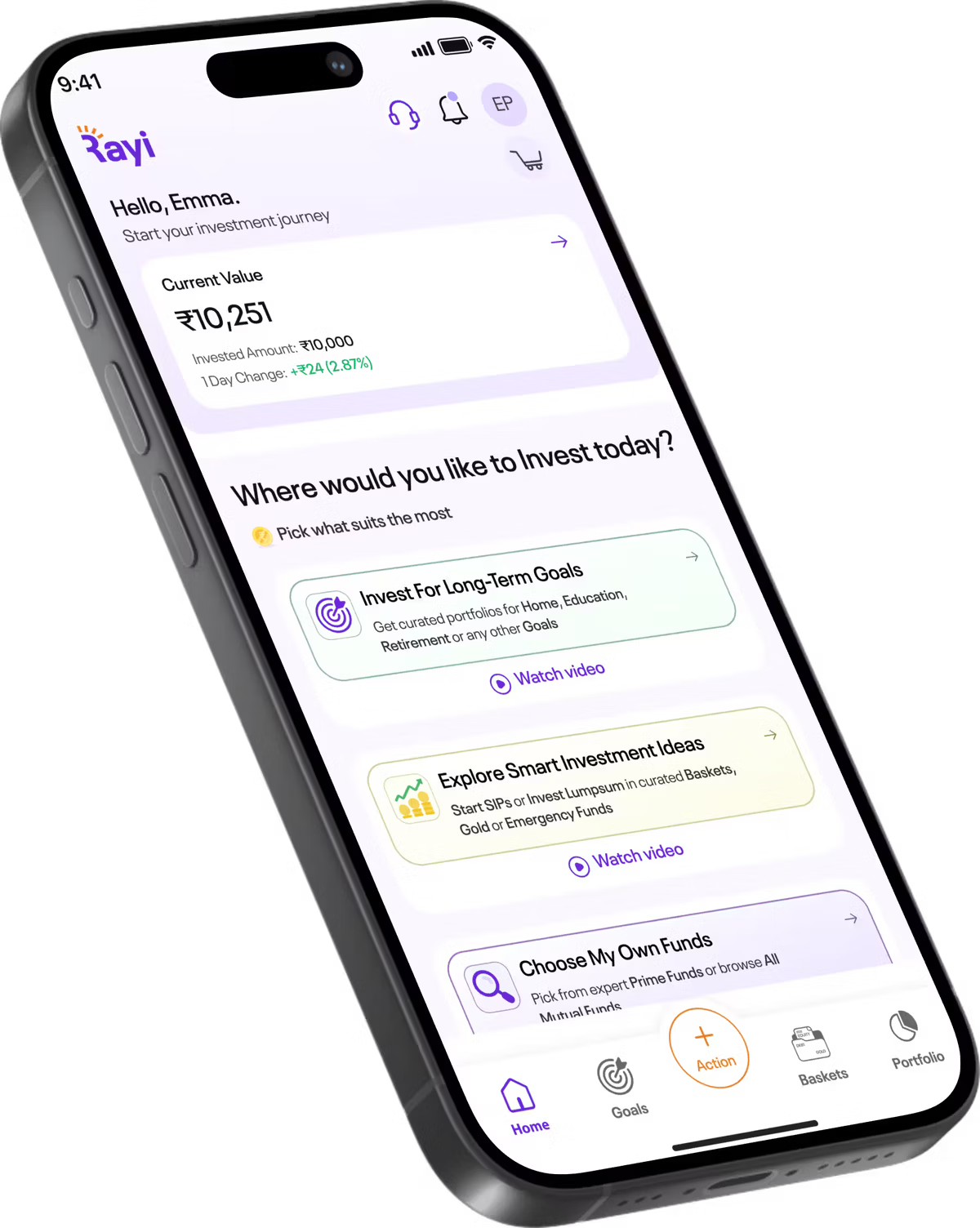

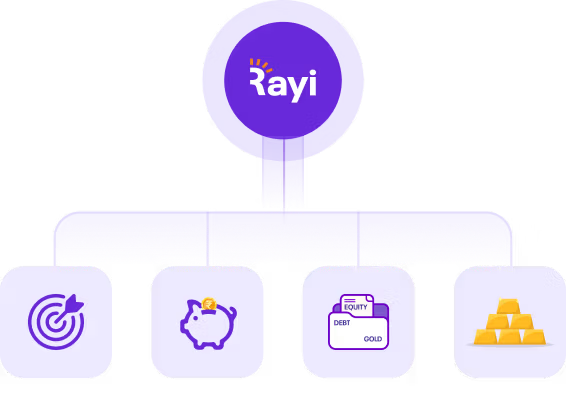

From Goal-based Investing to Smart Baskets, Mutual Funds, and Gold, Rayi helps you build wealth with clarity, confidence, and care.

Start smart. Start with Rayi.

Download the mobile

application today

Other investments

Dream house

Smart baskets

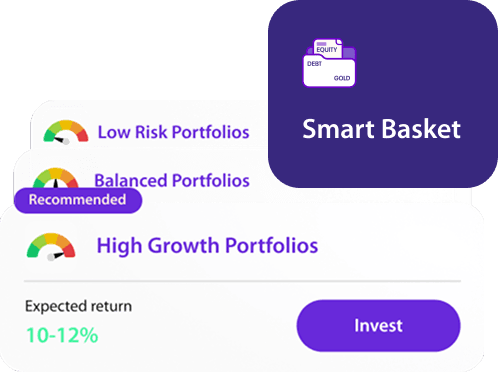

Our Smart Baskets are ready made portfolios of low risk, balanced, and high growth mutual fund schemes, curated by independent experts. Choose your investments with confidence.

Prime Funds are a filtered list of recommendations across mutual fund categories, that makes your choice super easy. They are curated by independent experts at Prime Investors and backed by in-depth research to remove any bias.

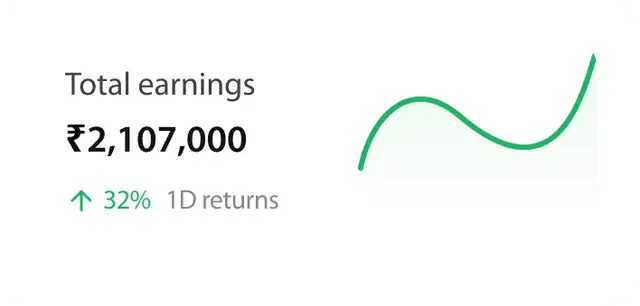

See your investments the smart way-neatly grouped into goals, smart baskets, self-managed and others for clarity that traditional views can’t match.

Handle all your family’s financial profiles from one powerful app—effortless, organised, secure.

Whether it's a dream home, your child’s education, or a secure retirement, start investing today to bring your goals to life, one step at a time.

Explore curated baskets—low risk, balanced, or high growth—to help simplify your investment choices

Start investing in gold funds with just ₹100 using Gold Maxx-an intelligent, hassle-free way to build long-term wealth.

Instant investing, effortless growth. Start with just ₹500 and let your money work smarter. Redeem up to ₹50,000 instantly !

Investing, the way it should feel, simple, smart, and safe.

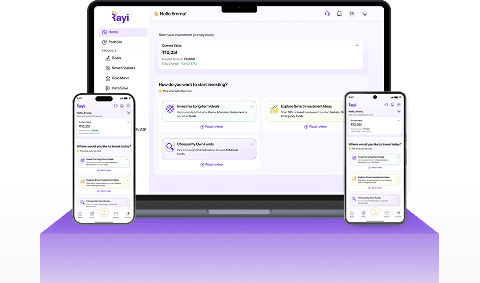

Rayi is a digital platform built to simplify mutual fund investing, making it easier for you to plan, invest, and grow your wealth with confidence.

Whether you're just starting or scaling up, Rayi helps you take control of your financial future through smart guidance, intuitive design, and innovative products. Because your financial goals deserve more than guesswork.

Inspired by the Sanskrit word “Rayi”, —meaning wealth or prosperity, our mission is to empower every individual to reach their financial goals, no matter where they begin.

Mutual Funds

Goals

Smart Baskets

Gold Maxx

Insta Save

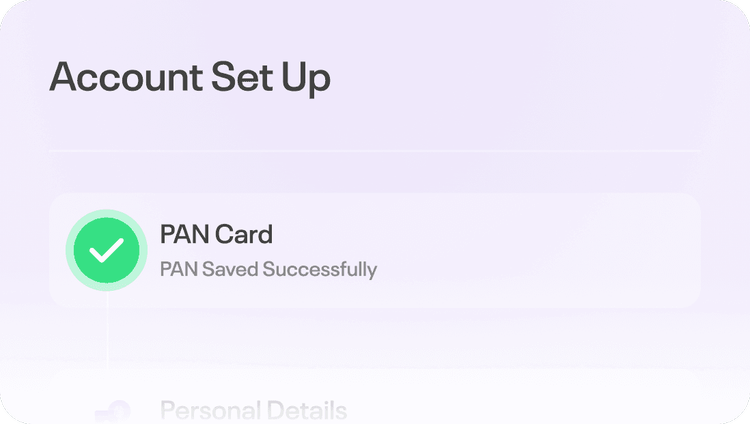

Whether you're a resident Indian or NRI, create your account in minutes, fully digital, zero hassle. From PAN to bank linking, Rayi’s step-by-step onboarding gets you started fast.

Discover thousands of mutual fund schemes from top AMCs. Find investments that match your goals—growth, income, or stability.

Effortless investing on Web, Android, and iOS. Stay connected to your financial goals anytime, anywhere with Rayi.

From SIP, SWP, STP, NFO & more — explore all types of mutual fund investments, right at your fingertips, anytime you need.

Rayi is proudly powered by ONDC, the government backed open network digital commerce platform. Just as UPI transformed digital payments, ONDC is now making investments seamless, interoperable, and platform-agnostic.

Biometric login and SSL encryption ensure your personal information always remains private and secure. We never share your data with 3rd parties, with no aggressive product pushes ever.

But if we didn't, just reach out to us and we'll be happy to answer your questions.

Rayi helps you invest smarter.

#StartYourRayi

Download the app to begin.

Disclaimer: Mutual Fund distribution services are offered through Goalhive Financial Services Private Limited, registered with AMFI as a Mutual Fund Distributor with ARN 307650. **Mutual fund investments are subject to market risks, read all scheme related documents carefully.** Terms and conditions of the website are applicable. Privacy policy of the website is applicable.